EPS Workshop

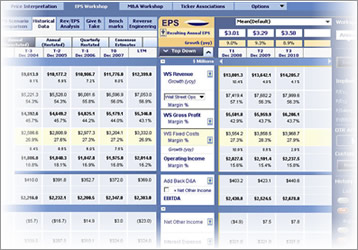

This module is dedicated to facilitating the PROCON user’s construction, de-construction, benchmarking and verification of income statement assumptions that could justify EPS projections, working top-down from revenue or bottom-up from earnings per share, with as little effort as possible.

For any selected company, EPS Workshop pre-populates each line item of its projected income statement with default assumptions based on a combination of Wall Street projections and historical analysis of the company’s data. To customize an assumption, simply edit the corresponding cell for the specific line item and projection quarter or year.

In fact, PROCON provides the option not only to enter a new value directly, but also to choose from a contextual dropdown menu presenting a variety of alternative assumptions for that cell, each accessible with a single mouse-click, including values derived from statistical studies of the company’s historical data and the projected values for that period for each of the company’s user-defined peers.

Our patent-pending Reverse Engineering functionality helps to verify for a company the achievability of an earnings projection (or maybe a “whisper number” circulating on the Street) with the press of a button. Just enter a bottom-line earnings number and instantaneously analyze possible combinations of operating assumptions that could justify those earnings.

|

|

click for larger view click for larger view |

Upon honing in on a rational scenario, press the corresponding cell on our sensitivity matrix to populate a benchmarking table demonstrating how key operating assumptions from that scenario rank versus those of the company’s peers.

To explore the reasonableness of a revenue projection with similar ease, use PROCON’s Give and Take™ feature, which helps to contextualize a company’s historical revenue growth and market share versus its competitors and assess its ability to achieve projected growth through a combination of industry-wide growth and market share gains. If the company’s projection seems too great based upon general market expansion, this tool set lets the user easily analyze how much market share it would have to steal from each of its competitors to meet these expectations.

To further inform the projection analysis, EPS Workshop features a comprehensive array of easy-access tools for customizing and benchmarking the projected income statement assumptions for any selected company, including its various operating margins, versus the company’s own history and the current corresponding values for user-defined comp groups. These tools include interactive graphing capabilities for the user to place the workshop revenue and earnings projections into context relative to up to 20 years of historical actual and trended data for the company and Wall Street’s then-current expectations. |