Price Interpretation

Harnessing the power and innovation of OCE’s patents-pending Market Topography technology, PROCON enables users to learn about a company’s evolving positioning within the marketplace by direct comparison with companies that they understand best, even cutting across industries.

In terms easy to comprehend, PROCON explains relative valuations of stocks head-to-head, currently and across time periods going back 20 years, through attribution of differences in their priced expectations, company characteristics and market conditions, all measured as of the user-specified date(s).

Our Price Interpretation tool sets enhance each user’s ability to keep valuation in perspective, with unique Average Experience Benchmarks for stocks and an unprecedented flexibility, through customized analysis, to contextualize their relative value drivers and gauge how aggressively they are priced versus other stocks. |

|

click for larger view click for larger view |

Our Based on Experience™ module, featuring OCE’s novel Priced Growth Years™ and Priced Duration Growth™ metrics, is powered by patent-pending tools which allow users to hone contextualized insights into the relative long-term growth rates and company-specific elements baked into stock prices.

- See how a stock would be priced today, given current market conditions, assuming that going forward the company could be expected to replicate the fundamental performance actually achieved by one or more similar companies over the past 50 years.

- We provide proprietary, easy-to-interpret statistics that shed meaningful light on otherwise amorphous information conventionally provided on financial sites all over the Web.

- For example, PROCON goes beyond mere display of Wall Street’s published long-term percentage growth rate estimate for a company by also supplying invaluable context to understand its meaning. With a simple key stroke, actually quantify for how long the market would have to believe a company will sustain that growth rate to justify its current price . . . and compare that to the time horizon priced into the average stock with that same published growth rate.

To gain additional insights into the reasonableness of valuation in a constantly shifting marketplace, run instantaneous valuation simulations factoring in a company’s current fundamental profile and Wall Street consensus earnings expectations but applying market conditions from user-selected historical time periods.

- For more conservative benchmarking, enhance these simulations using our Value Perspective engine, which extrapolates from historical earnings achievements, rather than relying on the more speculative Wall Street consensus about the future.

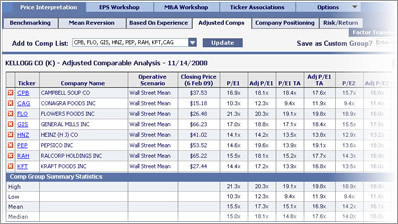

PROCON also features a module dedicated to enhanced trading comps analysis, which facilitates apples-to-apples comparisons and allows the user to customize the valuation analysis by incorporating specifically selected characteristics of comparison companies that the user chooses to capture, such as dividend policy, expected growth, financial leverage, and unique trading premium or discount.

In addition, our cutting-edge stock screening tool, which accesses not only traditional criteria but also PROCON’s full suite of proprietary measurements, is especially handy for developing new investment ideas which capture how stocks are positioned at any time within the market’s varied and shifting topographical landscape. |

|

click for larger view click for larger view |

|